All You Need to Know About Roof Hail Damage Insurance Claims

Year in and year out, the U.S. faces strong hailstorms. This translates to almost $1 billion of commercial and residential damages. So how can you secure a decent payment? Here are some things to know:

Proper inspection

When it comes to hail damage roof insurance, it’s important that you get your property inspected properly. Hire a reliable contractor experienced in handling a hail damage inspection checklist. This way, you can get an accurate cost needed for replacements or repairs. It’s not enough that you see large holes. A professional inspector will see deeper damages that may cost more. If you own a business establishment, it’s pressing to invest in the proper inspection.

File early

Never wait another week before you contact your insurer. The longer you let the damages lingering, the more chances the insurer will reduce the payout amount. Even if you’re not sure if there are serious damages, it’s better to report it to the insurance company. Through that, the adjuster can take a look which will allow you to arrive in an early settlement. Also, the late filing will raise suspicion on the insurer’s part. They will think that you’re trying to rig the claim.

Know when to repair and replace

When it comes to deciding whether to repair or replace, never trust the recommendation of the insurance company adjuster. Sure thing, they will go to the cheapest option of patching the roof instead of replacing the cracked tiles. Always ask the opinion of a contractor and a public adjuster. These two people will guide you on what to demand from your insurer.

Always take photographs in different angles together with other documentation.

What if I get denied?

A lot of hailstorm claims get denied due to a variety of reasons. If ever you’re caught in the situation, always prepare to appeal the denial. Most insurance companies reward insurers who can come up with the cheapest and fastest settlement. And since hail damage is costly, this makes sense why a denial is likely to happen.

The help of public adjusters

When it comes to hail damage roof car and home, a public adjuster will be a big help. This person will fight to get the right payment for your damaged property. Like the adjusters from your insurance company, public adjusters will run their own inspection. More likely, they will discover more damages that require a bigger amount for repairs.

After that, the public adjuster will help you document and appeal the denial. They are knowledgeable on the ins and outs of insurance policies. If you’re not familiar with the technicalities, a public adjuster would be worth hiring.

Assurant Insurance

Professional help will make roof hail damage insurance claim easier to settle. Also, public adjusters and contractors will ensure that you’re getting the right payment for the exact damages.

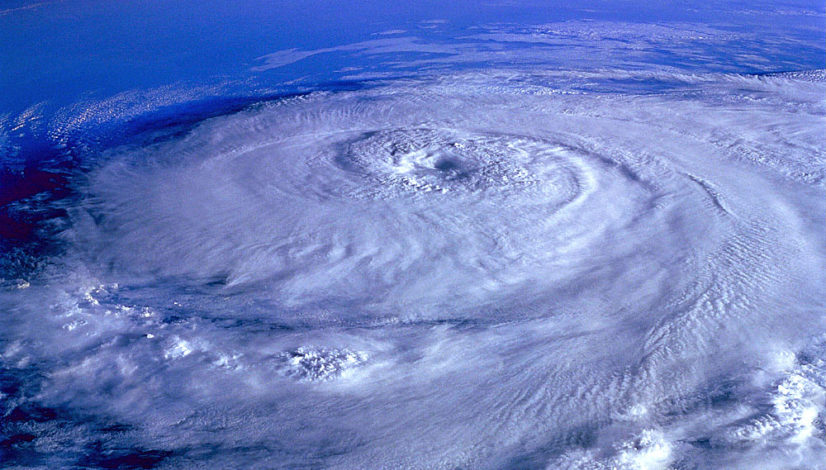

According to the National Weather Center, it is useful to organize your hurricane season preparation in stages

According to the National Weather Center, it is useful to organize your hurricane season preparation in stages